First-time homebuyer resource library

Homebuying resources you can share with your borrowers

Our first-time homebuyer library is brimming with tools and information to help educate and empower your borrowers. From financial readiness and credit tips to budgeting and navigating the mortgage process, these resources will help you guide your borrowers every step of the way.

-

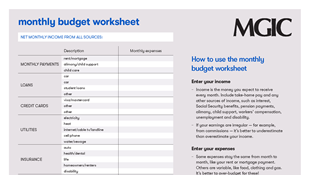

Monthly budget worksheet

Borrowers saving up for a down payment can use this worksheet to track their expenses and create a livable budget.

-

Budgeting

Explains the importance of budgeting and how to evaluate spending patterns to uncover savings opportunities.

-

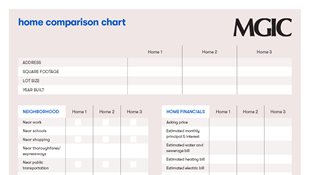

Home comparison chart

Borrowers can use this chart to compare the features of up to 3 houses.

-

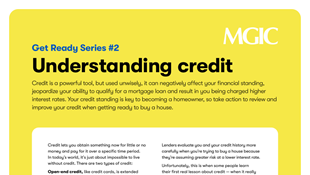

Understanding credit

Explains how to establish and maintain — or regain — good credit.

-

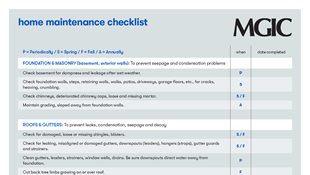

Home maintenance checklist

Share this handy checklist with new homeowners to help them keep their homes in tip-top shape.

-

Understanding your credit report

Explains how lenders review credit history to determine borrowers’ creditworthiness.

-

Preventing identity theft

Explains how to protect your credit standing by protecting your identity.

-

Down payment options

Explains mortgage options that might help borrowers find more down payment funds or put less down.

-

Is your credit score making the grade?

Help your borrowers master the credit score basics with this handy infographic.

-

The scoop on MI

Mortgage insurance allows your borrowers to put less than 20% down on a house. This shareable outlines the basics.

-

How to cancel mortgage insurance

Share this simple guide to explain when and how your borrowers can cancel mortgage insurance.

-

Your road home

Share this interactive digital map with your borrowers to link them to resources that will help them along the road to the home of their dreams.

-

Buy Now vs. Wait Calculator flyer

Help your borrowers understand the value of our Buy Now vs. Wait Calculator.

-

9 pitfalls that can trip up your loan closing

Share this list with borrowers to help them avoid taking actions that could derail the closing process.

-

Calculator flyer for consumers

Invite potential borrowers to explore our 5 easy-to-use homebuying calculators.

-

Readynest overview flyer

Introduce your borrowers to the helpful tips, tools and everything else Readynest has to offer.

-

The truth about buying your first home

Highlight financial and practical aspects of homeownership borrowers may overlook with this 10-point checklist.

-

The truth about private mortgage insurance

Illustrate the advantages MI brings to achieving homeownership through real-life examples.

-

The truth about 6 mortgage myths

Debunk the 6 most persistent myths today's homebuyers believe.

Help homebuyers crunch the numbers

Empower consumers with our consumer calculators to help them see how buying a home can be affordable.

Host your own homebuyer seminar

Attract and build relationships with prospective homebuyers by helping them understand the homebuying process.

Helping homebuyers made easier

Visit this one-stop spot for tools and resources to educate and inspire your prospective borrowers about the homebuying process.