Mortgage Connects knowledge hub

-

Updated for tax year 2025: Self-employed borrower and income analysis calculators

Designed to calculate income for self-employed borrowers, salaried borrowers, rental properties and more.

-

Build referral partnerships with 5 proven habits

Discover 5 reliable ways to expand referral networks and bolster borrower leads.

-

A portrait of millennials

See how younger and older millennials compare and find out how to help both overcome their misperceptions and obstacles to homeownership.

-

Latest Loan Originators Survey Report

Gain new insights on marketing, referrals, productivity and more in the 2025 Loan Originators Survey Report.

-

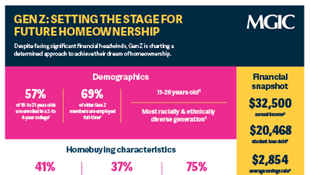

Meet the freshest homebuyers: Gen Z

Some Gen Zers are too young to rent a car, but those old enough to buy a home know exactly what they want. Find out their preferences.

-

Sneak peek at the 2025 Loan Originators Survey results

Get an early look at the findings of the 2025 Loan Originators Survey!

-

The latest credit updates from Mike Olden

Mike Olden of American Reporting Company (ARC) discusses trigger leads, credit reporting costs, medical debt and more.

-

Use community lending to turn “mortgage ready” renters into homeowners

Leverage targeted strategies to engage and convert ready borrowers in your community.

-

Magic Minutes: All About MI - MI for first-time homebuyers

Find out how using private MI as a financial tool can help more renters buy a home with as little as 3% down

-

Young Hispanics: Driving homeownership (and business) opportunities

2 unique things Hispanic homebuyers are doing to mitigate market challenges, and how lenders can support them.

-

Community Lending Field Guide

Resources designed to equip lenders with tools, insights and consultative support to help grow homeownership in their communities.

-

How to reframe the conversation about MI to give you a competitive edge

Focus on your borrowers' and referral partners' ultimate goals – and how mortgage insurance can help them achieve those goals – to differentiate yourself from the competition.

-

How community lenders can build homeowners early

Integrate financial literacy into your community lending strategy to prepare future homeowners.

-

The costs of homeownership – and the value of mortgage insurance

MI is one of the few products in the homebuying process that has actually decreased in cost.

-

How to show up on social media

Consider the vibe, audience and content of 4 key social media platforms to maintain a consistent online presence.

-

Down payment options

Let potential borrowers know there are other strategies beyond a 20% down payment for buying a home. Use our ready-to-use social media post to spread the word that you can help them.

-

4 questions to ask yourself to unlock community lending opportunities

Grow your footprint by connecting more borrowers to sustainable homeownership.

-

Meet today's first-time homebuyers

Traits, trends and preferences you need to know to build trust and foster relationships with first-time homebuyers.

-

Credit score basics

Explain how credit scores can impact many areas of your borrowers' lives with this ready-to-share social post to get conversations started.

-

Homebuyer education options

Get information on homebuyer education programs that help borrowers understand the homebuying process from start to finish.

-

Magic Minutes: All About MI - MI cancellation

Borrower-paid private mortgage insurance can be cancelled. Find out about eligibility conditions, and when and how to cancel it.

-

Share your customer success stories

Make a positive impression on future borrowers by sharing homebuying success stories of your current borrowers. Fill in the details and add a personal touch to this ready-made social media post!

-

Market update

Connect with potential borrowers by sharing your industry knowledge. Use our ready-to-post social media template to provide market updates.

-

8 ways to make your social media posts more compelling

Get a breakdown of the key components of a great social media post, plus engaging content examples.

-

Magic Minutes: All About MI - MI for move-up buyers

Find out why you should talk to move-up buyers about mortgage insurance even if they have a 20% down payment.

-

Hispanic homebuyer profile

Use the insights in this infographic to help you meet the needs of Hispanic borrowers – the fastest-growing homebuyer demographic.

-

Home financing options

Use this social post to spread the word that you can help would-be borrowers explore all their home financing options to meet their goals.

-

Boosting affordability through down payment assistance programs

Angel Romero of Down Payment Resource discusses how to layer down payment assistance for maximum affordability and more.

-

Credit clarity and updates for loan originators

Mike Olden of American Reporting Company (ARC) answers the most frequently asked questions about credit scores and credit reporting.

-

Dreaming of owning a home?

Stay in front of potential borrowers and let them know you can help them achieve homeownership dreams by sharing this social post.

-

Success starts here: Homebuyer education as a key to lasting ownership

Insights from our interview with Finally Home!.

-

Magic Minutes: All About MI - What & why MI

Learn what mortgage insurance is and why you should bring it up in conversations with borrowers and real estate agents.

-

Buy now or wait

Let borrowers know you can help them with their big decision of "Should I buy now or wait?" Share this social post to let borrowers know you have a tool to help them run the numbers.

-

Structuring mortgage loans using gift funds

As a mortgage professional, learning the nuances of gift fund requirements for conventional mortgage loans can help you explore all options with your borrowers.

-

Q&A session

Host a live Q&A session to demonstrate your expertise on the mortgage process. Use this ready-made social media post to share the event with your followers.

-

Refinancing benefits

Use this social shareable to build awareness with homeowners that refinancing their mortgage loan can be used as a strategy to meet their financial goals.

-

The value of homeownership

Share this ready-made social media post with potential borrowers to remind them of the benefits of homeownership.

-

Borrower testimonials

Attract potential new borrowers by celebrating the successful closing of your current borrowers' new homes. Use this social post to also highlight your role in helping them to achieve their dream.

-

Homebuying process

Highlight your knowledge of the homebuying process for first-time buyers by sharing this social media post so you stay you top of mind with potential borrowers.

-

9 pitfalls that can trip up your loan closing

Catch borrowers' attention before it's too late by sharing this ready-to-use social post on how to avoid common loan closing pitfalls.

-

Beyond the mortgage: Comprehensive support for first-time homebuyers

Insights from our interview with Housing Resources, Inc.

-

The #1 way to provide value to your real estate agent referral partners

The answer? Responsive service! Get 3 key strategies to strengthen referral relationships and become the go-to loan officer for your real estate agents.

-

Magic Minutes: All About MI - Choice Monthly premium plan

Learn how Choice Monthly differs from traditional premium plans and how it can benefit both budget-conscious borrowers and loan officers.

-

7 top referral sources for savvy loan officers

Learn how to nurture ties with partners both inside and outside the mortgage industry.

-

Magic Minutes: All About MI - MI premium plans

Explore MGIC's 4 most popular premium plans at a high level.

-

Debunking homebuying myths for millennials: Key insights from NAMMBA

Learn how to address 4 common myths that may be holding millennial homebuyers back.

-

Highlights of the 2024 Loan Originators Survey

We share key findings from the latest Loan Originators Survey, conducted by MGIC and Loan Officer Hub.

-

Sample credit solicitation opt-out letter

Use this sample text provided by Mike Olden of American Reporting Company to help consumers opt out of credit solicitations.

-

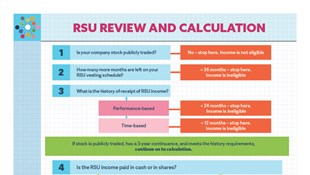

RSU review and calculation tool

Easily determine the eligibility of restricted stock unit income and calculate monthly qualifying income in cash or shares.

-

The untapped referral opportunity of financial advisors

Gibran Nicholas discusses the often-overlooked potential of financial advisors as high-quality referral sources for loan officers.

-

How to prepare borrowers for sustainable homeownership

Heather Bowman of Finally Home!® discusses the power of education for homebuyers and homeowners throughout the purchase process and beyond.

-

Celebrating Hispanic Heritage Month: An interview with Danny Garcia-Velez, MGIC

Danny Garcia-Velez, SVP of sales and business development for MGIC, shares his perspective on leadership, inclusivity and remembering his roots.

-

Magic Minutes: Evaluating & Calculating Borrowers' Income - Restricted stock units

Are restricted stock units part of your borrower’s compensation? Don’t panic. This tutorial will take you step by step through the process of documenting, analyzing and calculating income from this source.

-

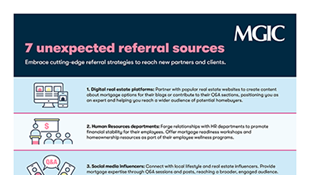

7 unexpected referral sources for loan officers

To gain an edge over the competition, loan officers may need to go beyond traditional referral sources. These 7 unexpected referral sources could help you find a new niche.

-

A Hispanic mortgage professional's insights on connecting with Latino homebuyers

Get a deeper understanding of the Hispanic culture so you can be in a better position to help mortgage-ready Hispanic borrowers achieve their dreams of homeownership.

-

Educating your borrowers is the key to building a robust mortgage pipeline

By positioning yourself as a trusted advisor through proactive education, you not only assist buyers but can also secure more business. Discover 7 key strategies.

-

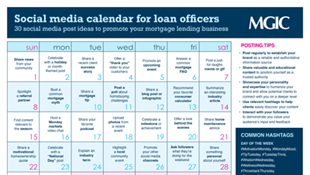

Social media calendar for mortgage pros

Boost your online presence with our social media calendar for loan officers! Get 30 post ideas, trending hashtags and expert tips to attract leads and build client relationships.

-

Cracking the code: 7 secrets to mastering your local real estate market

A deep understanding of local market dynamics is your secret weapon. Discover how to crack the code to real estate success and build trust with clients and partners.

-

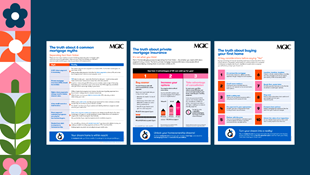

Mortgage myths bundle: Now available in English & Spanish

Share our popular myth-busting series with your borrowers and referral partners. Includes: "The truth about 6 common mortgage myths," "The truth about private mortgage insurance" and "The truth about buying your first home."

-

Loan Officer Sales Playbook

Whether you're a new loan officer or a seasoned pro, the basics of selling are key to your success. The 7 topics in this ultimate guide for LOs will help you get started or brush up your skills.

-

How to educate your way to a full pipeline

Mortgage experts Heather Bowman, Finally Home!®; Tay Toliver, Thrive Mortgage; and Dustin Owens, The Loan Officer Podcast share innovative strategies to help you maintain a full pipeline through borrower education.

-

Magic Minutes: Analyzing Self-Employed Income - Business liquidity

Gain a better understanding of business liquidity and the role this accounting principle plays in analyzing the stability of self-employed borrower income.

-

3 ways homebuyer education benefits mortgage professionals and borrowers

Discover how making a small investment in homebuyer education will pay big dividends for you and your customers.

-

The truth about buying your first home

Share this 10-point checklist with your borrowers to equip them with essential truths about budgeting, credit, emergency funds and more.

-

Building a financial legacy through smart real estate investment

Listen as Marc Williams, senior loan officer at Paramount Residential Mortgage Group, shares insights into how financial literacy can boost wealth-building efforts through homeownership.

-

12 lead-generating social media posts for mortgage pros

Amplify your online presence by capitalizing on the power of social media. 12 pre-made posts are ready for you to download and start sharing on your social networks today.

-

Financial literacy: Your secret weapon to empower borrowers for success

By championing financial literacy, you're not just helping borrowers – you're building stronger relationships and fostering a more responsible lending environment. See how you can make a difference.

-

Homebuyer readiness quiz

Share this fun 10-question quiz with your would-be borrowers to help them find out how much they know (and don’t know) about the homebuying process. Available in English or Spanish.

-

The truth about private mortgage insurance

Share these 3 real-life examples of how MI's advantages can help them achieve their homeownership dreams.

-

Survey reveals positive outlook for community banks

What do statistics tell us about the future of homeownership and what does it mean for community banks? Take a look at the reasons community banks could be at an advantage for future growth.

-

3 reasons Mortgage Connects is the new go-to destination for lending pros

Introducing the new Mortgage Connects knowledge hub. 100s of resources in ONE destination—all yours and curated to help you meet today’s industry challenges and grow your business.

-

Magic Minutes: Analyzing Self-Employed Income - Vehicle mileage depreciation I

This overview tutorial defines the difference between the use of actual expenses and standard deduction when it comes to adding back vehicle mileage depreciation in a Schedule C.

-

Magic Minutes: Analyzing Self-Employed Income - Vehicle mileage depreciation II

Watch these 3 real-life case studies and learn: where to look for business miles on tax forms; how to confirm the use of standard deduction; and what common mistakes to avoid.

-

Magic Minutes: Analyzing Self-Employed Income - Clearing up K-1 confusion

Discover how Schedule K-1s affect mortgage qualification in this video. View 5 common scenarios to learn who gets them, why they matter and how to use earnings.

-

6 mortgage myth-busting social media posts for loan officers

Take advantage of the power of social media to generate leads and referrals with curated posts and images ready to download, post and share.

-

Mastering self-employed borrower income analysis for tax year 2023

We cover the latest SEB income calculation tools for the 2023 tax year, plus IRS tax and GSE guideline changes that may affect cash flow.

-

HR departments: Golden opportunities for loan officer referrals

How LOs can partner with HR departments to connect with large groups of potential homebuyers.

-

Interactive map links borrowers to helpful resources

Help your homebuyers see the milestones ahead and stay the course to their ultimate destination - the home of their dreams.

-

Empower your borrowers with the Get Ready! guide series

From budgeting and understanding credit to preventing identity theft and navigating down payment options, this informational series provides borrowers with essential keys to successful homeownership.

-

Turning social media into a mortgage marketing powerhouse

Kayla Kallander, mortgage loan officer at First International Bank & Trust, shares actionable tips and tricks to help mortgage professionals maximize their social media strategies.

-

Navigating the mortgage terrain in 2024

Listen in as Kevin Peranio, chief lending officer at PRMG, reveals top strategies to thrive in the current interest rate environment amidst the challenges of the mortgage industry.

-

Showing your borrowers all their options is even more important in a tough market

Debunk common mortgage myths and show prospective borrowers all their options to help guide them on their homebuying journey.

-

The truth about 6 common mortgage myths

This handy guide is chock-full of facts to help loan officers and real estate agents debunk the 6 most persistent myths today's homebuyers believe.

-

Magic Minutes: Analyzing Self-Employed Income - Business structures

Discover how understanding the different types of business structures can help you analyze your self-employed borrowers' income.

-

Magic Minutes: Analyzing Self-Employed Income - Cash flow analysis

Learn how to look at income from a mortgage perspective, 3 key concepts used during the cash flowing process and how to analyze earnings trends to correctly calculate qualifying income.

-

Magic Minutes: Analyzing Self-Employed Income - Eligibility requirements

This foundational video discusses who can be considered self-employed, eligibility requirements and what facts must be considered when evaluating self-employed income.

-

Magic Minutes: Analyzing Self-Employed Income - Documentation requirements

See how correctly documenting your file can expedite turn times, what tools can help you confidently calculate qualifying income and more about Fannie Mae and Freddie Mac documentation.

-

2023 Loan Originators Survey Report: Mortgage trends revealed

Uncover important mortgage industry insights to help build your referral strategies from MGIC's 2023 Loan Originators Survey Report.

-

Magic Minutes - Evaluating & Calculating Borrowers' Income - Calculate fixed income

Get tips to determine the difference between bi-weekly and semi-monthly pay, as well as the importance of validating income documentation before calculating borrowers' qualifying income.

-

Magic Minutes - Evaluating & Calculating Borrowers' Income - Challenging income

This brief video provides guidance for calculating income for borrowers who are teachers, postal workers, seasonal or union workers, or in the military.

-

Magic Minutes training series

Our on-demand video training series helps loan officers, lenders and other mortgage industry professionals expand their knowledge in 15 minutes or less.

-

Magic Minutes - Evaluating & Calculating Borrowers' Income - Calculate non-taxable income

Explore non-taxable income, like Social Security, child support and alimony, and learn how to “gross up” the non-taxable portion of borrowers' income to arrive at adjusted gross income.

-

Magic Minutes - Evaluating & Calculating Borrowers' Income - Income conundrums

This brief tutorial helps you prepare for calculating your borrower's income under unusual circumstances, like when your borrower is unemployed or on leave.

-

Magic Minutes - Evaluating & Calculating Borrowers' Income - Qualifying income

Learn how to determine if employment and income can be used for qualifying, the difference between fixed and variable income and more.

-

Magic Minutes - Evaluating & Calculating Borrowers' Income - Calculate variable income

This brief tutorial shows how assessing the overall risk present in a file plays an important role in income calculation and delivers some helpful guidelines for calculating variable income.

-

Bridging cultures and building trust with Hispanic homebuyers

An interview with Daniel Gomez, branch manager at DHI Mortgage, in recognition of Hispanic Heritage Month.

-

Credit score fundamentals

An educational tool for your borrowers to help them understand the meaning behind their credit score numbers and how they can improve their score.

-

Think you know about Hispanic homebuyers?

Watch this video to learn about Hispanic homebuyers, a vibrant, growing origination opportunity.

-

Hispanic marketing resources

Explore our library of resources (available in English and Spanish) to understand, reach and guide mortgage-ready Hispanics on the journey to homeownership and expand your market.

-

Referral-building workshops

Ready-made workshops help you build stronger relationships with real estate agents and other referral partners. Gain access to everything you need to host a business-building workshop.

-

Asking the right questions: A conversation on referral strategies with Ron Vaimberg

Mortgage industry coach/trainer Ron Vaimberg shares tips for loan officers to connect with referral partners, including the right questions to ask and how to play to your strengths.

-

Self-employed borrower and employment and other income calculators

Gain access to MGIC's editable and auto-calculating self-employed borrower and income analysis worksheets.

-

9 pitfalls that can trip up your loan closing

Handy list educates borrowers on what they should avoid doing during the mortgage process to help ensure their loan is approved on time.

-

A winning mindset: Adding value to referral partners to earn their business

Listen in as Matt Weaver, VP of mortgage sales at CrossCountry Mortgage, discusses referral partner relationships and strategies.

-

PAL Kaua’i founder Jim Edmonds discusses affordable housing solutions in Hawaii

Hear about PAL Kauai’i’s mission to provide permanently affordable and sustainable living solutions for the people of Hawaii.

-

Connecting, leading and growing a diverse future for the mortgage industry

Discover more about the National Association of Minority Mortgage Bankers of America (NAMMBA) from its director of corporate solutions, Jade Winfrey.

-

Consumer calculators: Help renters and potential homebuyers understand their options

User-friendly homebuying calculators help borrowers crunch the numbers to see that buying a home is possible.

-

Buy Now vs. Wait Calculator flyer

This handy flyer introduces potential homebuyers to our Buy Now vs. Wait Calculator that instantly provides a comprehensive comparison of the financial implications of either choice.

-

Buy Now vs. Wait Calculator

This user-friendly calculator quickly shows renters and first-time homebuyers why it could make financial sense for them to buy a home now rather than wait to save a 20% down payment.

-

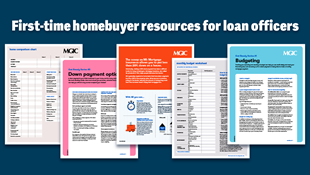

First-time homebuyer resource library

Access tools and information you can use to educate and guide your borrowers through the homebuying journey. Available in English and Spanish.

-

An interview with Trena Bond, executive director at Housing Resources, Inc.

Learn about the ways Housing Resources, Inc., opens the door to homeownership though comprehensive homebuyer education, help overcoming obstacles and financial empowerment.

-

Evaluating self-employed borrower income for tax year 2022

Customer trainer Sandra Sweeney discusses MGIC’s comprehensive self-employed borrower resource program - including the cash flow worksheets for 2022.

-

A credit conversation with Mike Olden, American Reporting Company

Hear about soft and hard credit inquiries, credit score factors and other credit-related topics from Mike Olden, VP of sales & education at American Reporting Company.

-

Get Ready! guide #5 - Down payment options

This shareable guide explains mortgage insurance options that might help your borrowers find more down payment funds or put less down. Part 5 of our Get Ready! series.

-

Get Ready! guide #3 - Understanding your credit report

Help borrowers understand how lenders review credit history to determine their creditworthiness by sharing this useful guide. Part 3 of our Get Ready! series.

-

Get Ready! guide #4 - Preventing identity theft

This informative guide details how preventing identity theft is key for borrowers in protecting their credit standing. Part 4 of our Get Ready! series.

-

The scoop on MI

Mortgage insurance allows your buyers to put down less than 20%. Pass along the MI basics with this information sheet.

-

Get Ready! guide #1 - Budgeting

This practical guide explains the importance of budgeting and how to evaluate spending patterns to uncover savings opportunities. Part 1 of our Get Ready! series.

-

Get Ready! guide #2 - Understanding credit

Help your borrowers learn how to establish and maintain - or regain - good credit by sharing this useful guide. Part 2 of our Get Ready! series.

-

How loan officers can get started working with referral partners

Get practical advice from a top loan originator for growing and building referral partner relationships.

-

Characteristics of 5 common self-employed businesses

Practical guide explains the characteristics of the 5 common business structures of self-employed borrowers: sole proprietorship, partnership, S corporation, corporation and LLC.

-

MGIC Premium Plans

See a quick comparison of MGIC's 4 most popular premium plans, including BPMI Monthly, BPMI Single, BPMI Choice Monthly and LPMI Single Premiums.

-

MI Solutions for first-time homebuyers

See how mortgage insurance can help your first-time homebuyers buy sooner and build more equity with a lower down payment.

-

Connecting mortgage pros and homebuyers with down payment assistance programs

Hear from Sean Moss, EVP at Down Payment Resource, about how this enterprise tool can help mortgage pros find, explore, track and monitor DPA programs in their area.

-

MI Solutions for move-up buyers

Watch this video to learn about the ways mortgage insurance can help move-up buyers afford more home by putting down less than 20%.

-

Rethink MI: Fresh solutions for lenders and loan officers

This quick-hitting video provides an overview of ways mortgage insurance can help broaden borrowers' financial options to find the loan that works best for them.

-

2022 Loan Originators Survey Report: A sneak peek

A quick-hitting summary of insights gleaned from MGIC's 2022 Loan Originators Survey Report.

-

Celebrating Hispanic Heritage Month: An interview with Hipolito Garcia, OneTrust Home Loans

Hipolito "Hip" Garcia, vice president at OneTrust Home Loans, discusses why Latinos are the driving force behind the housing market.

-

Down Payment Connect

Down Payment Connect is the affordable, effortless down payment assistance look-up tool that delivers quick access to available DPA programs in your borrowers' state.

-

Down Payment Resource

Down Payment Resource’s database of homeownership programs and suite of tools helps lenders connect their borrowers to the DPA assistance they need.

-

An interview with Krystina Kohler, leader of United Way's Safe & Stable Homes initiative

Learn more about United Way’s Safe & Stable Homes initiative to improve housing and financial security and end family homelessness in Greater Milwaukee and Waukesha County.

-

Increase your lending impact by assisting a new generation of homebuyers

An insider’s experience in developing a multicultural lending action plan and his advice to loan officers looking to serve more diverse communities.

-

A conversation with Karen Chiu, builder development manager at New American Funding

Listen as Karen Chiu discusses her experiences and insights into the challenges many Asian Americans face in homebuying and the mortgage industry.

-

Finding opportunity in adversity: A conversation with top originator Ryan Hills

Listen as Ryan Hills, regional director of Movement Mortgage, talks about the evolution of his business and successful career as a top originator and content creator.

-

An interview with Loan Officer Joanna Garcia, U.S. Bank

Discover how Joanna Garcia realized her own American Dream by helping her Cuban community realize theirs.

-

Fannie Mae & Freddie Mac credit score model update

Jeff Platfoot, MGIC customer trainer, covers what mortgage industry pros can expect as Fannie Mae and Freddie Mac pivot from the classic FICO model to new credit score models.

-

Just get started: An interview with Steve Kyles, top producer at SMP Mortgage Inc.

Steve Kyles, partner with Mortgage Animals, shares insights and tools that have helped him succeed for over 17 years in the mortgage industry.

-

The powerful mindset of top mortgage loan originators

Bestselling author Todd Duncan talks about the importance of mindset, attitude and knowing your "why" in building a successful career in the mortgage and real estate industries.

-

eClose and the future of the digital mortgage process

Discover more about eClose and Service First Mortgage's experience with this digital mortgage process.

-

MI standard coverage 101

Take a deeper dive into the term “standard coverage” and its direct impact on lenders with MGIC’s customer trainer, Jeff Platfoot.

-

Helping Hispanics prepare for homeownership

Maria Vergara, director of community lending at Fannie Mae, reveals why working with Hispanic homebuyers should be part of lenders’ origination strategies.

-

Celebrating Hispanic Heritage Month: An interview with Eddy Perez, Equity Prime Mortgage

“Freedom is everything” to Eddy Perez, CMB, co-founder and CEO of Equity Prime Mortgage. Learn how his family’s immigration from Cuba shaped Eddy’s future and success.

-

Celebrating Hispanic Heritage Month: An interview with Angel Alban, Zventus

Angel Alban, president at Zventus and chairman/co-founder of blockchain Hyperledger Mortgage Subgroup, shares why working hard, helping others and dreaming big can make it happen.

-

Celebrating Hispanic Heritage Month: An interview with Armando Falcon, Falcon Capital Advisors

Armando Falcon, CEO of Falcon Capital Advisors LLC, expounds on his efforts to clean up the operations of the GSEs before the financial crisis as well as mortgage finance reforms.

-

How to be productive in a seller's market

Hear about the ways Service First Mortgage overcame operations, recruitment and marketing challenges post-pandemic.

-

Is your social presence up to regulatory snuff?

Discover the do's and don'ts of keeping social media profiles and posts compliant in the highly-regulated financial industry.

-

An interview with top producer Joel Mahakian, Premium Mortgage Corp.

Joel Mahakian offers advice for those pursuing a successful career in the mortgage industry, including how “when you do the right thing, the money will come.”

-

Overcoming industry obstacles while fostering relationships

Gain industry insights and tips to overcome obstacles and grow your business from Phil Treadwell, national director of sales innovation & strategy for Thrive Mortgage.

-

Growing your business through Instagram

Chelsea Peitz dives into the essentials that business professionals should consider when building their personal brand on Instagram.

-

Maximize your social media outreach

Key insights from Kyle Draper, social media guru, about where mortgage professionals should be spending their time on social media to maximize their reach.

-

All things gift-related in the mortgage industry

Take a deeper dive into specific requirements for gift documentation with MGIC's national trainer, Hali Plachecki.

-

Honoring AAPI Heritage Month: An interview with Jim Park, TMC

Jim Park, executive chairman and founding partner of The Mortgage Collaborative, discusses strategies for connecting with Asian Americans in the mortgage industry.

-

Honoring Black History Month: An interview with Senator Tim Scott

Senator Tim Scott, South Carolina, shares how his humble beginnings and the guidance from role models and mentors led to his life of public service.

-

Honoring Black History Month: An interview with Tony Thompson, NAMMBA

Tony Thompson shares how the lack of women, millennials and minorities in the mortgage banking industry was the impetus for founding the National Association of Minority Bankers of America.

-

Honoring Black History Month: An interview with Lisa Rice, NFHA

Lisa Rice, president & CEO of National Fair Housing Alliance, discusses how the legacy of discrimination resulted in disparities of wealth, homeownership and opportunity.

-

MI Solutions

Uncover MI strategies to help you broaden your borrower's financial options, create new opportunities and earn more deals.

-

Readynest

Send your potential homebuyers to Readynest for tips, tools, and information that breaks down the homebuying process into bite-size topics. Accessible in English and Spanish.

-

Loan Officer Hub

Loan Officer Hub, powered by MGIC, gathers the best information and resources from around the mortgage industry to help loan officers grow, learn and succeed. Get the latest insights!

-

Consumer homebuying calculators

Use this handy guide to MGIC's consumer calculators to help homebuyers understand their financial options.

-

5 fast facts about creating a budget

Help your customers get a jump-start on creating a realistic household budget by sharing these useful tips from Readynest.

-

When and how to cancel MGIC mortgage insurance

Access this step-by-step guide for borrower-requested and lender-required MGIC mortgage insurance cancellation under HPA, Fannie Mae and Freddie Mac guidelines.

-

How to cancel MI

Get the basics about cancelling mortgage insurance in this step-by-step guide (available in English and Spanish).

-

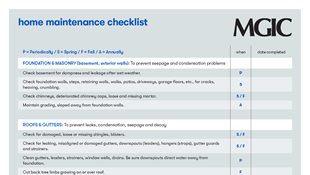

Home maintenance checklist

This home maintenance checklist helps homeowners decide when to perform a maintenance checkup and what to look for.

-

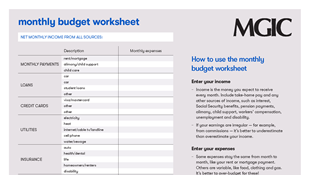

Monthly budget worksheet

Borrowers saving up for a down payment can use this worksheet to track their expenses and create a livable budget.

-

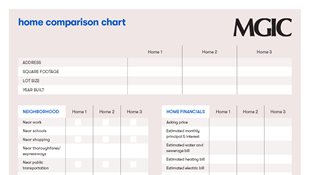

Home comparison chart

Homebuyers can use this chart to compare the features of up to 3 houses.

Get the latest insights and resources – delivered to you in real time

Be among the first to know when fresh content has been added to the knowledge hub. Subscribe now for our email alerts that give you a head start on leveraging business-building resources and insights to help you thrive in your career.